The global economy is once again at a crossroads as U.S. President Donald Trump’s new tariff measures ripple across financial markets and international trade. The euro has surged to a four-month high as investors react to economic uncertainty, while Tesla’s stock is suffering from a nearly 50% drop in China sales.

Meanwhile, Canada has struck back, with Prime Minister Justin Trudeau announcing retaliatory tariffs, backed by provincial premierswho are taking bold economic measures. In the U.S., political and economic leaders are split, with some pushing for negotiations while Trump remains defiant.

With tariffs now at the center of global economic turbulence, the world watches to see how currencies, equities, and trade alliances will respond in the coming months.

“We fought and died alongside you. Is this how you treat your allies?” Trudeau stated in an emotional address to Canadians.

I. The Euro Surges as Trade Tensions Roil Markets

The EUR/USD currency pair has reached its highest level in four months, soaring above $1.06, as markets digest the impact of new U.S. tariffs on imports from Canada, Mexico, and China. Investors are beginning to diversify away from the dollar, fearing long-term instability tied to global trade disruptions.

Adding to the euro’s strength is Germany’s move to relax its debt constraints, a fiscal policy shift that aims to stimulate its economy amid fears of a broader trade war. This increased government spending in the eurozone is viewed as a stabilizing force, contrasting with U.S. economic protectionism.

“The U.S. dollar is facing pressure as investors hedge against prolonged trade conflicts, and the euro stands to benefit from this shift,” said an analyst at Deutsche Bank.

II. Tesla’s Stock Plummets as China Sales Collapse

Amid the economic turbulence, Tesla’s stock has suffered a steep 4% drop, driven by a staggering 49.2% decline in sales of China-made Tesla vehicles in February—its lowest since August 2022.

Is Tesla losing its foothold in one of the world’s largest EV markets?

“The combination of geopolitical risks and intensifying competition is putting Tesla in a difficult position,”an investment strategist at Goldman Sachs remarked.

III. Canada’s Retaliatory Strike: Trudeau and Premiers Take Action

Prime Minister Justin Trudeau has responded forcefully to the 25% U.S. tariffs on Canadian exports, implementing counter-tariffs on $30 billion worth of U.S. goods, with a promise to escalate to $125 billion if necessary.

Trudeau described the U.S. tariffs as a betrayal of Canada’s long-standing alliance with the U.S. and has vowed to challenge the measures in both the World Trade Organization and USMCA dispute mechanisms.

Meanwhile, Canadian provincial premiers have taken matters into their own hands, Ontario’s Doug Ford has long repeatedly threatened to cut electricity exports to the U.S., stating “They need to feel the pain.” as per video below

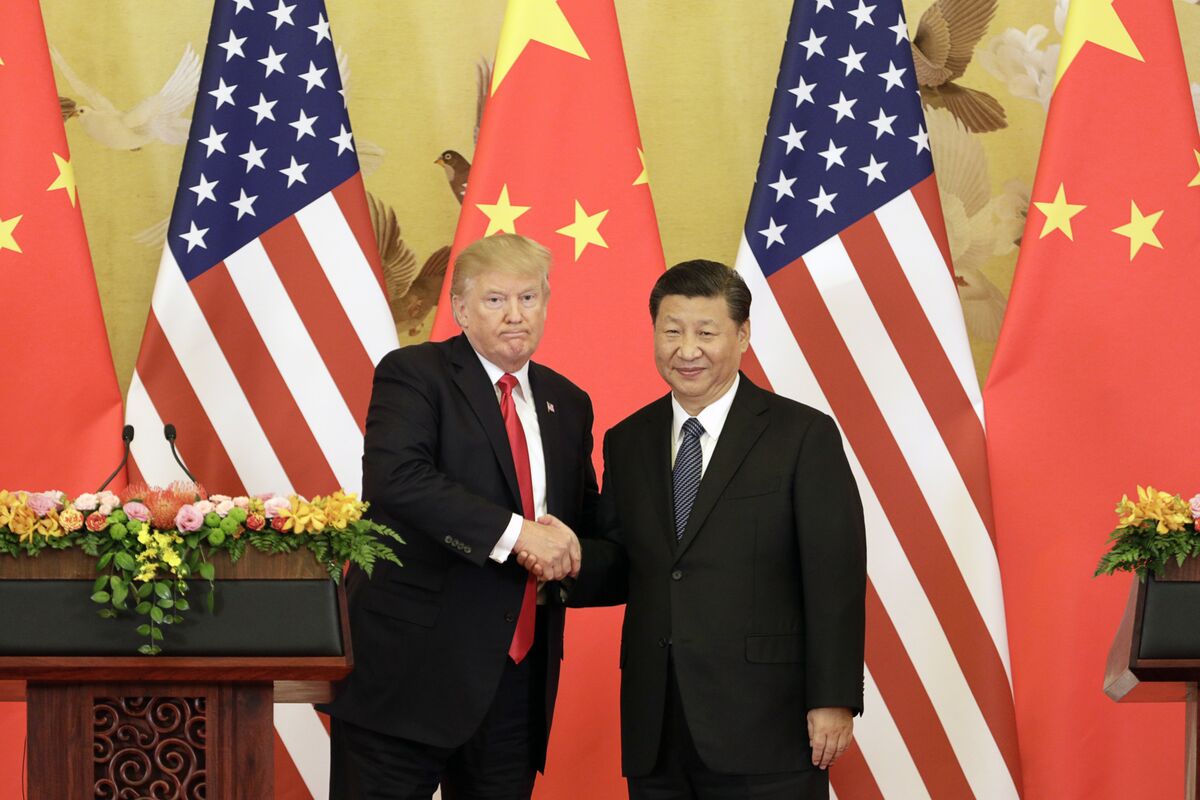

IV. The U.S. Response: Trump Stands Firm, Officials Seek Compromise

While Canadian leaders push back, President Donald Trump remains steadfast in defending the tariffs. He mocked Justin Trudeau, referring to him as “Governor Trudeau” and implying that Canada should be part of the U.S.

However, some U.S. officials are calling for negotiations, Commerce Secretary Howard Lutnick stated that the U.S. might consider exempting certain industries, particularly the auto sector, from the steepest tariff measures. Meanwhile, the White House granted a one-month tariff exemption for U.S. automakers importing from Canada and Mexico, following pressure from Ford, General Motors, and Stellantis.

Despite this potential softening in policy, the overall U.S. stance remains aggressive, with Trump threatening even more tariffs if trade partners do not comply.

“Trudeau is just using this situation to stay in power,” Trump declared in a recent post on his Truth Social platform.

Discover more from sbnn

Subscribe to get the latest posts sent to your email.